Klarna Chameleon

Is it a Bank? Is it a Payments Network? Is it an Ad Company?

“It’s no surprise skeptics are coming after us. We are challenging one of the largest profit pools ever created by humanity – the profit pools of the world’s biggest banks.” — Sebastian Siemiatkowski, Klarna Founder & CEO, in the company’s IPO filing prospectus.

On April 10, 2005, at exactly 11:06:40, Swedish fintech company Klarna processed its first transaction. The merchant was a local book subscription service called Pocketklubben that had launched a couple of years earlier. In the offline world, consumers were happy to use debit cards to pay for goods but online they were wary about paying up front for items that would be dispatched later. Klarna’s founder, Sebastian Siemiatkowski, devised an elegant solution while working for an invoice factoring company: a business that pays merchants immediately and collects from customers after delivery, absorbing the risk in the middle. The idea got him accepted into the Stockholm School of Economics startup incubator where Pocketklubben was a recent graduate.

Twenty years later, Klarna is preparing to IPO on the New York Stock Exchange. The company has transformed considerably since those early days, evolving into a global fintech giant operating in 26 countries. Today, its pink logo adorns the checkout pages of more than 675,000 merchants (sadly, Pocketklubben is no longer one of them). In 2024, the platform served 93 million active customers who collectively made over a billion transactions worth $102 billion in gross merchandise volume. With a rebranded name, relocated headquarters, and an expanded suite of products that extends far beyond its original invoice service, Klarna has become one of the world’s most recognized financial brands.1

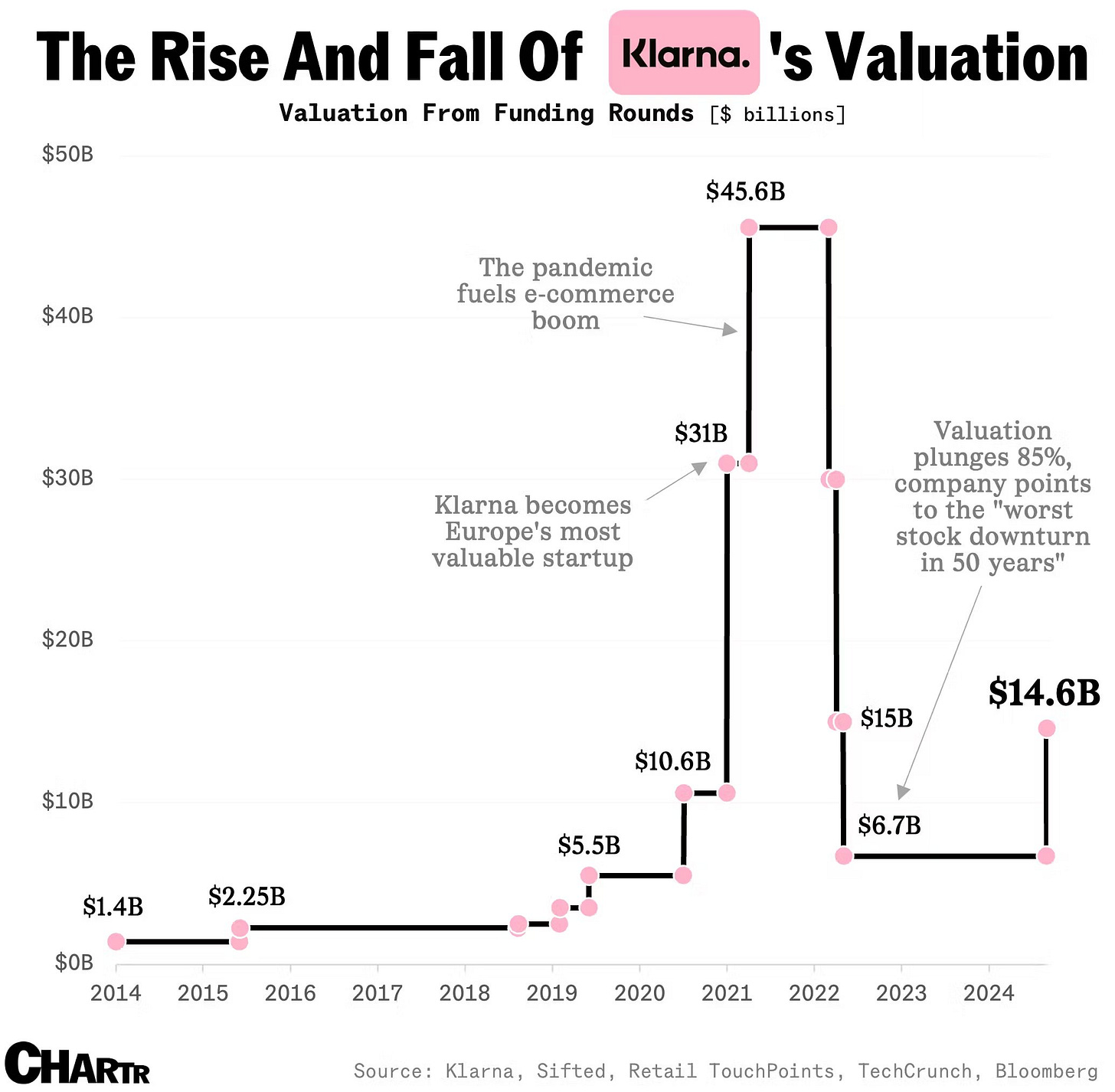

But the path from Swedish startup to Wall Street IPO has been anything but linear. Klarna’s valuation history tells part of the story: a peak of $45.6 billion in 2021 followed by an 85% collapse to $6.7 billion in 2022, before a partial recovery as the IPO approaches. These dramatic swings reflect not just market sentiment, but fundamental shifts in the company’s business model, regulatory positioning, and strategic focus. Like a financial chameleon, Klarna has repeatedly adapted its form to optimize for changing environments, executing a series of critical pivots that redefined its business. To explore those transformations and to see what clues the filing prospectus holds for the company’s future prospects, read on.