Brand vs Build

How JPMorgan Is Buying Into the UK Banking Market

When JPMorgan launched its Chase banking app in the UK in September 2021, its marketing approach was decidedly old-school. Rather than attempt to create virality around a waiting list or customer referral program, it splashed out on TV and cinema advertising spots.

The firm’s inaugural ad sets the tone. It opens outside a bustling coffee shop. David Tennant is the narrator. “Introducing Chase, the digital bank that makes every day rewarding,” he intones. “What does that mean?” asks a bleach-blond barista, mid-pour on a flat white. Tennant explains: “Well, you get 1% cashback on your everyday debit card spending.”

The ad runs through other account benefits – security protections, real human customer service – but the promise of free money lingers.

We cut to a pub (where else?). A man of retirement age, in maroon jumper, sits at a table holding a full pint in front of an untouched plate of pie, peas and mash. He turns to camera: “So… who are you again?”

“Chase. We’re a digital bank that’s already trusted by millions of customers in the US.”

“How many millions?”

“Well, over 56 millions.”

“Blimey.”

The ad crystallizes Chase’s positioning strategy: leverage American scale to build British trust. Where challenger banks like Monzo developed their brands as a rejection of traditional banking, Chase embraces its establishment credentials. The 56 million customer figure is social proof that Chase isn’t an untested startup but a proven operator. It reflects JPMorgan’s distinct advantage in the UK as a crossover between scaled incumbent and agile newcomer. The 1% cashback was a loss-leader only a bank with JPMorgan’s balance sheet could sustain, while the emphasis on American customer numbers provides reassurance that scrappy startups can’t match.

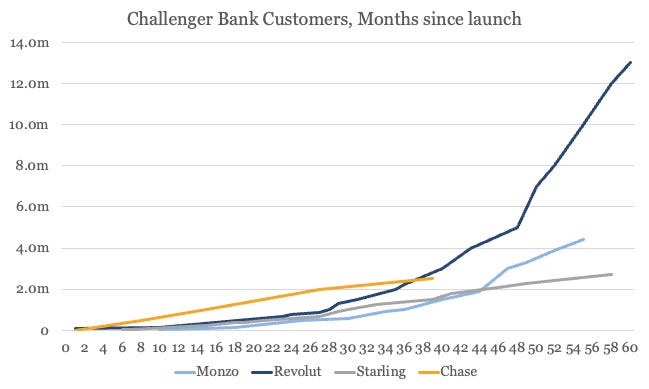

The launch was a success. Within eight months, the bank had won over half a million customers and raised $10 billion in deposits. By the end of 2023, it had 2 million customers and $22 billion of deposits (£17 billion). On its latest numbers – released last week – it has 2.5 million customers and $29 billion of deposits (£23 billion). Compared with Monzo, which launched six years earlier, it is already a third bigger in terms of deposits, and has a million more customers than Monzo did at the same stage of its development.

But the growth hasn’t come cheap. Before the ad even aired, JPMorgan had invested almost $450 million into the project. In its first full year of operations, it lost another $185 million. Although the business is now profitable, marketing spend has continued to escalate, totalling $470 million in the past three years. And while the first million customers came easily – attracted perhaps by the 1% cashback which has since been capped – the next million were more expensive to acquire. Marketing spend per net new customer has risen from around £125 in 2022 to £284 last year. That compares with a net customer acquisition cost of £42 at Monzo, which still gets two-thirds of its customers via word of mouth recommendations.

JPMorgan CEO Jamie Dimon argues the UK expansion is a long-term project. As the first retail venture the bank has launched overseas, it’s something he’s looking at quite closely. “I can open 100 branches in Mumbai or 100 branches in the UK, and there’s no chance I get enough share to make up for additional overhead,” he told investors three months before going live. “Digital changes that. And so what we’re doing digitally in the UK is a chance to see, can we do something different?… It’s a long-term play… And the UK is a beginning. If it works there, then we’ll think about other things you could do with that.”

As a testbed for global domination, then, it’s worth looking at. Four years on, is Chase UK working? To explore – with a bit of shade cast on Monzo along the way – read on.