Big Bang 2.0

The Tokenization of Everything

“I believe tokenization is the greatest capital markets innovation since the central limit order book.” — Vlad Tenev, Co-Founder and CEO of Robinhood Markets, July 8

Ten years ago this month, Ethereum went live as a new kind of blockchain. Marketed as “a censorship-proof world computer that anyone can program,” it launched with plenty of promise. Unlike Bitcoin, whose capability was limited mostly to transferring funds between accounts, Ethereum came with an expressive programming language that invited developers to build applications on top. As Apple did with its App Store, Ethereum’s founders encouraged developers to write and run apps – they wanted it to be “the underlying and imperceptible medium for every application, just what medieval scientists thought ether was,” according to one account.

Although its scope was wide-ranging, the technology lent itself to financial applications. The key innovation was smart contracts – self-executing programs that automatically enforce agreements when conditions are met. A smart contract could hold funds in escrow until both parties fulfill their obligations, automatically distribute loan payments based on preset terms, or execute trades when certain price thresholds are reached. Unlike traditional contracts that require intermediaries to enforce, smart contracts run on code, making them faster, cheaper, and accessible to anyone with an internet connection.

Yet despite its promise, Ethereum faced several challenges gaining real-word adoption. First, it was slow. At launch, Ethereum could support only approximately 15 transactions per second. Five years later, that had increased to 1,000 but it was still too slow for mainstream financial use. Second, its regulatory status was uncertain. To motivate people to operate it, Ethereum launched its own digital currency, ETH, but because the Securities and Exchange Commission offered only informal hints and no binding rulemaking, ETH languished in regulatory limbo – neither formally classified as a security nor clearly exempt – leaving mainstream institutions wary.

Finally, Ethereum suffered from what tech investor Chris Dixon characterizes as the battle between “the casino and the computer.” The casino side – focused on trading and speculation – often overshadowed the computer side, which was building serious infrastructure for the long term. The casino culture manifested in wild price swings and speculative manias. Even Ethereum’s principal founder, Vitalik Buterin, was troubled by this dynamic: during a 2017 boom that pushed ETH’s market cap past half a trillion dollars, he asked, “have we earned it?” Four years later, amid another speculative surge, he warned of the “dystopian potential” of digital assets if implemented incorrectly.

Now, though, these obstacles are being resolved.

For one, regulation is becoming clearer. The Securities and Exchange Commission recently hosted a roundtable on institutional crypto adoption. One panel member reflected: “I’ve been in this space since 2013, and if you told me that I’d be sitting on this panel today, back then, I probably would have bought more.” The underlying technology is also improving. Ethereum can now handle 65-100,000 transactions per second experimentally, with performance improving over time. The system has also proven remarkably resilient – Ethereum has not experienced a complete outage in its history, affording its applications extremely reliable uptime and accessibility.

Unsurprising then that institutions are beginning to take it more seriously:

Fidelity, Nasdaq, Invesco, Franklin Templeton, BlackRock and Apollo were all at the SEC’s roundtable alongside the crypto bro who should have bought more.

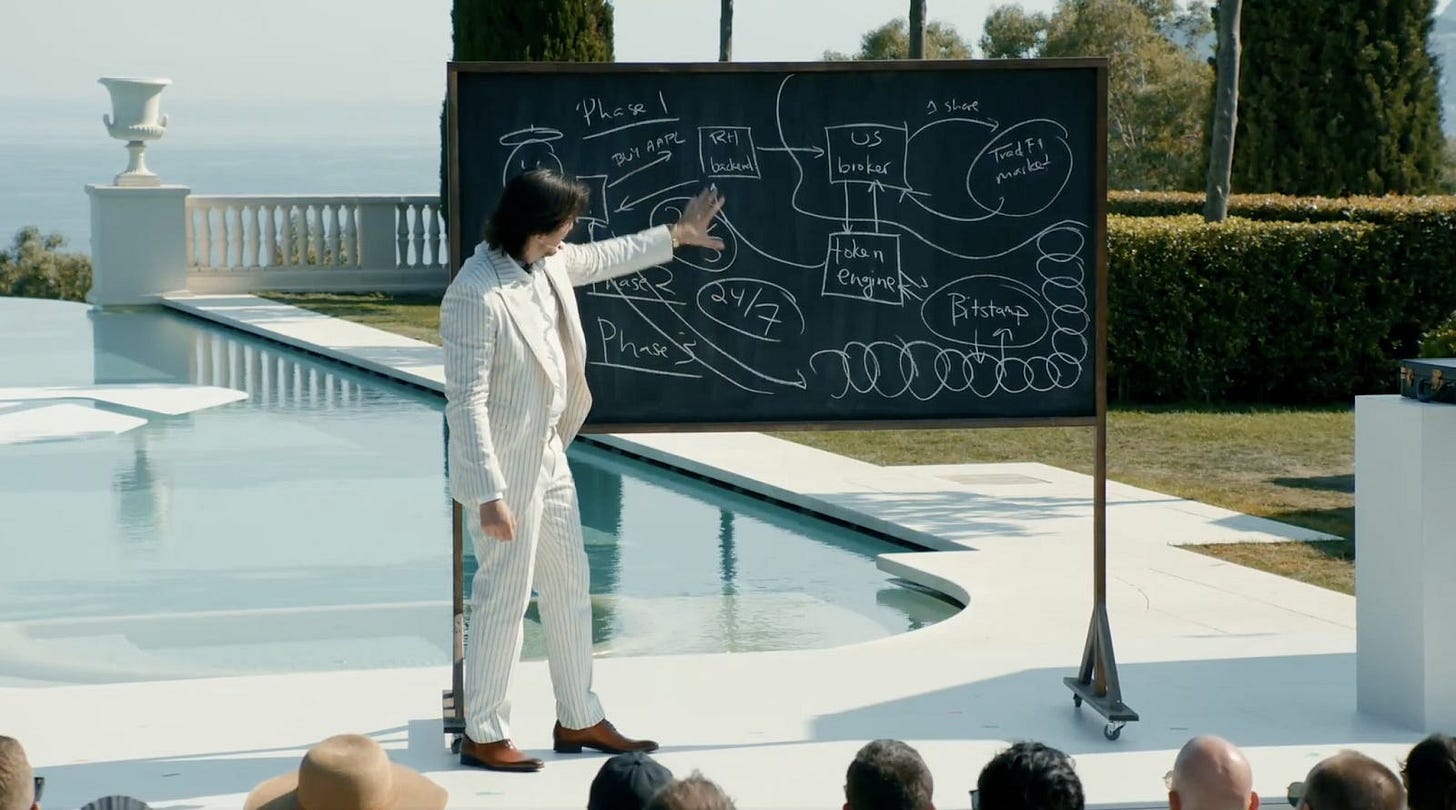

Last month, Robinhood hosted a presentation at the historic Château de la Croix-des-Gardes in Cannes – the setting of Hitchcock’s To Catch a Thief – where CEO Vlad Tenev launched a new tokenized asset product: blockchain-based representations of traditional investments that can be traded (and settled) 24 hours a day.

BlackRock’s institutional digital liquidity fund – a tokenized money market fund launched on Ethereum in March 2024 – has grown to a market cap of $2.8 billion. According to the company, its overall digital assets offering is now a $250 million revenue business.

BlackRock’s founder and CEO, Larry Fink, is bullish about the prospects for tokenized assets. “Every stock, every bond, every fund – every asset – can be tokenized,” he writes in his latest shareholder letter. “If they are, it will revolutionize investing. Markets wouldn’t need to close. Transactions that currently take days would clear in seconds. And billions of dollars currently immobilized by settlement delays could be reinvested immediately back into the economy, generating more growth. Perhaps most importantly, tokenization makes investing much more democratic.”

We touched on tokenization as a theme back in December. To explore it further – including the specific risks and opportunities it presents – read on.